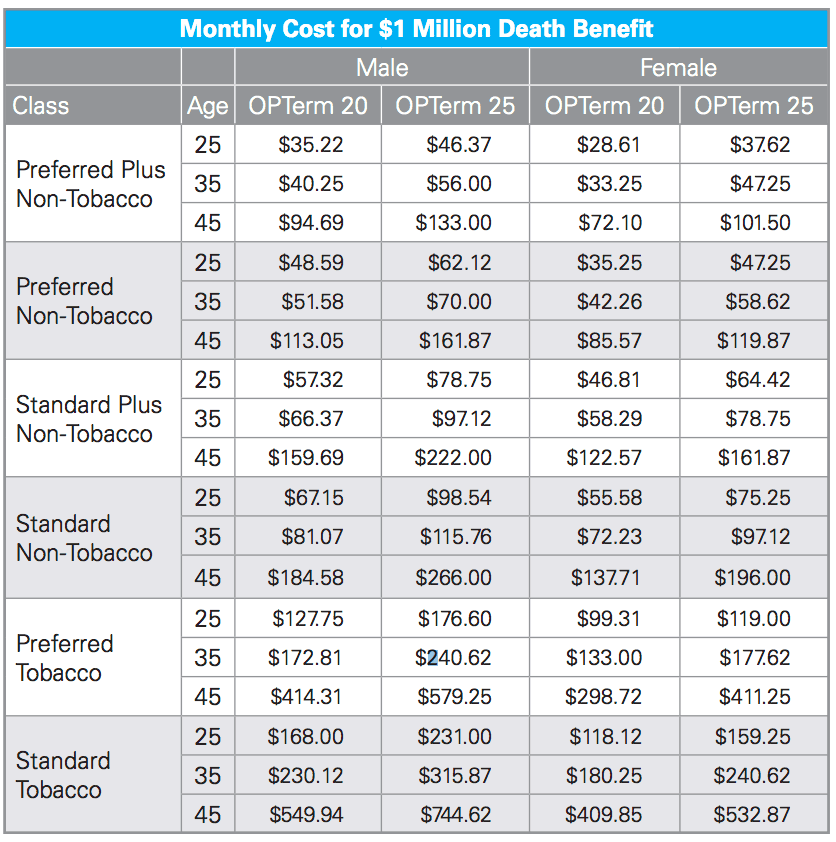

The price of a $1 million life insurance policy. Health factors, age, tobacco use and sex all weigh in heavily on the cost, as does the type of product and for how long the.

Mit Spinout Insurify Raises 2 Million To Replace Human Insurance Agents With A Robot Techcrunch Insurance Agent Insurance Compare Insurance

The best companies for a million dollar term life insurance policy.

2 million dollar life insurance policy. A million or $2,000,000 term life policy seems like a huge life insurance policy. The premium for a $2,000,000 ten year term life policy would most likely cost far less than buying 20 ten year term policies of $100,000. How much does a $2 million life insurance policy cost?

It’s as simple as it sounds, it’s a $1 million death benefit payout to your family if you pass away unexpectedly. 2 million dollars of life insurance this, of course, comes with the benefit of knowing your family is secure in the event something unfortunate happens. The contract comes into effect when they receive your first premium and remains in effect for the duration of the contract, as long as you continue to pay your premiums.

If you don’t have a lot in savings and you don’t have sources of income other than your job, this kind of coverage can be just what you need. The need to focus on a+ and a++ carriers is increased with this higher dollar coverage amount. What is a million dollar life insurance policy?

That’s a little more than $1 per day. The money comes with no strings attached, so your family can use it to replace your income, pay debts, or cover any other expenses. It may surprise you how affordable $1 million in coverage can be.

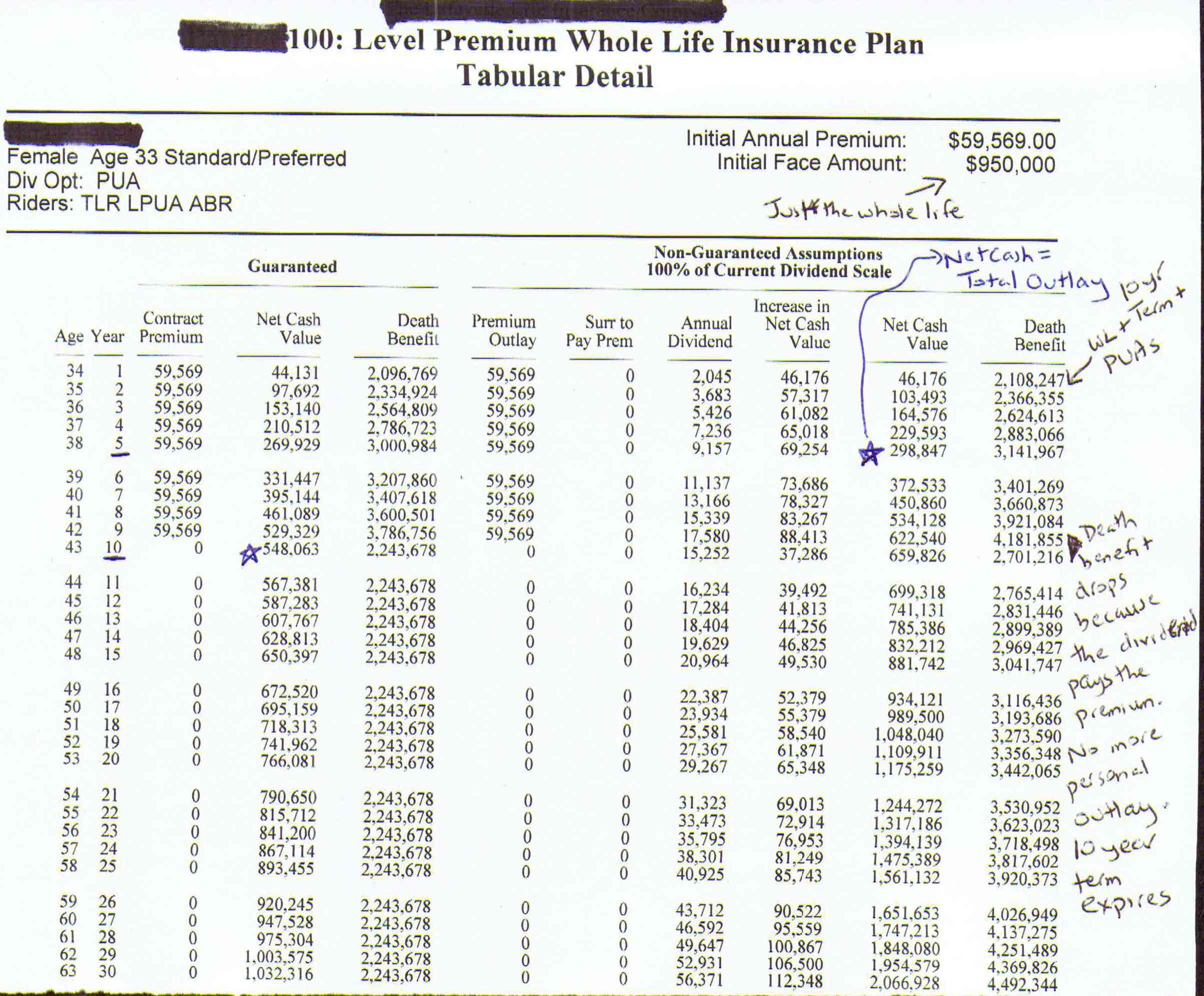

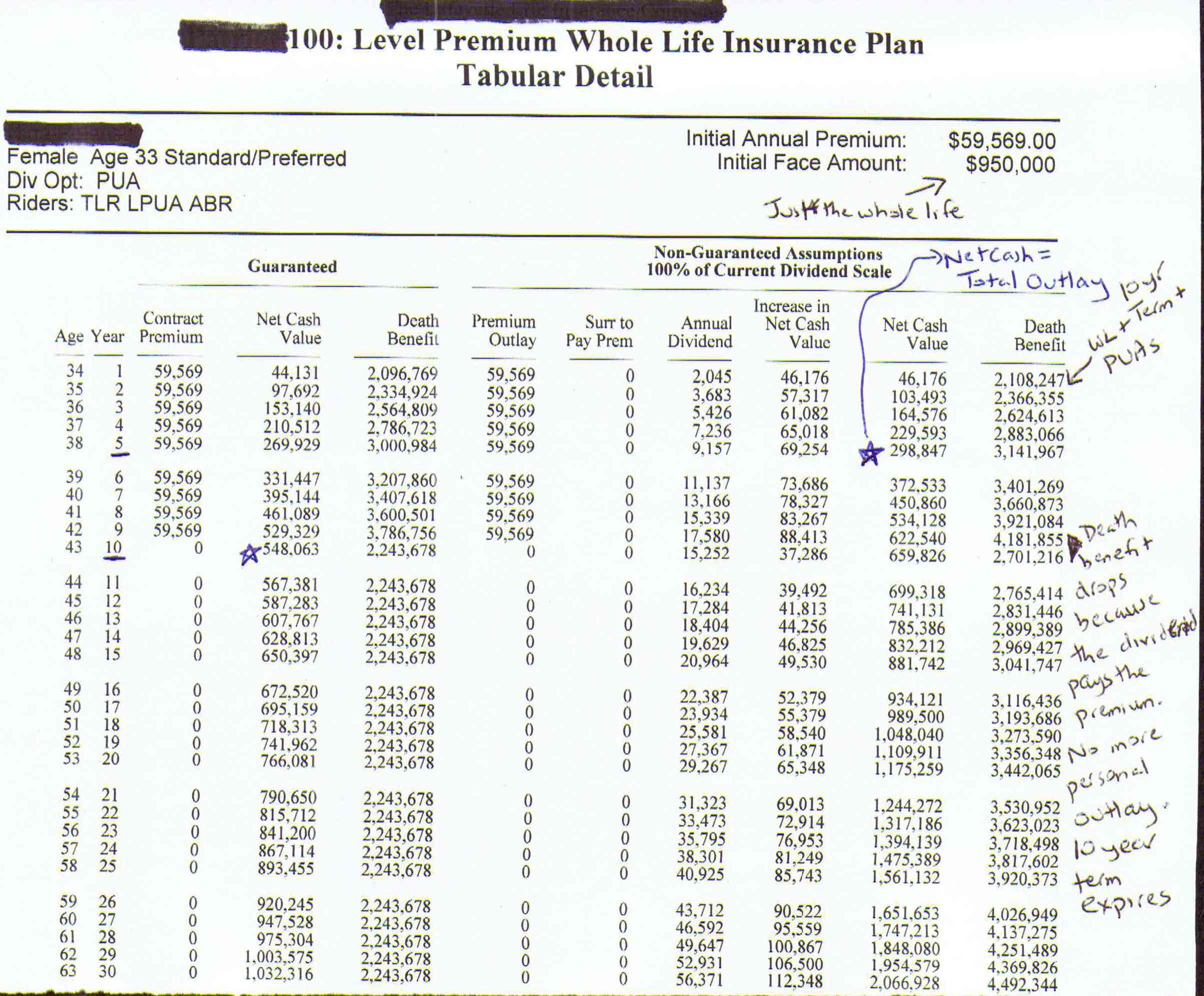

It will also depend on what type of coverage you get, with a $2 million term life insurance policy costing much less than whole life insurance. I would then have a longer term policy with the purpose of taking care of my wife before and after the kids are out of the hose. So, how much does 2 million in term life insurance cost?

The $2 million dollar term life insurance policy used to be considered an excessive amount. This coverage can be used to help replace your income or to pay debts or cover other expenses. Purchasing a 2 million dollar life insurance term policy can help wealthy executives cover personal and business life insurance needs.

A $2 million life insurance policy can cost as little as $2,000 for term life or $11,000 for guaranteed ul or $23,000 for whole life policy, annually. A million dollar life insurance policy is a contract with a face value of a million dollars made between you and the insurance company. You might be surprised to learn that “not just anyone” can buy a policy for, say, 4 million dollars.

Some say to multiply your salary by the number of years you have left before retirement. It’s costly, which is why most people purchase these types of policies as part of their overall investment and financial strategy, or on their very young children to ensure lifelong. But if you are the average american and your family relies on your income to survive then it’s important that you have enough coverage for both yourself and them in case something were to happen.

For me that would be an additional $500,000 to $1 million dollars of life insurance on a 30 year term policy. The rates for a $2 million life insurance policy range from $43 month for term insurance and up. Our experience has shown that some of the best rates for a $1 million dollar policy are from:

When you might need a $2 million life insurance policy. Net worth can also impact your insurance offer. It’s when you take a little time and look at the entire financial picture that you see how quickly it can go.

Purchasing $2,000,000 to $5,000,000 of life insurance coverage is commonly done by individuals with: The cost of a $2 million dollar life insurance policy depends on a number of variables, like your age, your health and the term length of your coverage. In fact, if you make more than $100,000 you should automatically consider a policy worth at least $1 million.

Plus, these policies have higher rates than more affordable policies that offer lower amounts or term lengths. You must be able to financially justify your need for the amount of coverage you desire. Even if they can afford the premiums.

Currently, most americans have less coverage than they need. No longer, while consumers are pulling in more and more income the need for higher amounts of simple and affordable term coverage has increased. Insurance agents and estate planners recommend six to 10 times your annual salary.

The idea of needing a 2 million dollar insurance policy, a 30 million dollar life insurance policy, or even a 100 million life insurance policy seems unimaginable. Can anyone get a million dollar life insurance policy? There is generally a lower cost per thousand at higher bands of face amounts.

Larger plans worth more will cover greater expenses, but at the same time end up with a higher monthly cost , though do not get too discouraged, million dollar life insurance might be cheaper than you think ! Not a bad price for a significant amount of peace of mind. If you earn over six figures, you might need a $2 million dollar policy.

For my family that would be a $2 million dollar policy. A million dollar life insurance policy sounds like a lot of coverage, but it’s actually not enough for most people because it only pays out $1,000,000 at death instead of the full amount on an annual basis. A medically underwritten term life policy can let you carry $2 million, $3 million, or possibly even more in coverage for the next 20 or 30 years as your family grows.

We can always shop around to find you the cheapest rate on $2 million worth of life insurance, or feel free to use our quote engine to run a comparison for yourself. How much does a $2 million life insurance policy cost? Just like it sounds, this policy means your life insurance company will provide a $1 million cash payout to your beneficiaries if you die while the policy is active.

All requires 30 years of.

Compare Million Dollar Life Insurance Policy Rates Top 5 Companies

How Does Whole Life Insurance Work Costs Types Faqs

Life Insurance Over 70 How To Find The Right Coverage

Pin On Infographic

5 Different Types Of Insurance Policies Coverage That You Need In 2021 Insurance Benefits Disability Insurance Emergency Medical

Paid Up Additions Work Magic In A Bank On Yourself Plan

What Does A 5-10 Million Dollar Life Insurance Policy Cost In 2021

Lowongan Kerja Pt Bni Life Insurance Terbaru 2016 Resolusi Gambar Asuransi Jiwa Teknik Komputer

Who Needs A 2 Million Life Insurance Policy Haven Life

Life Insurance Is More Affordable Than You Think Life Insurance Cost Term Life Term Insurance

Pin On My Pins

Why Almost Every Life Insurance Policy With Cash Value Stinks

Pin By Gmz Solutions On Globelife Life Children Life Insurance

Paid Up Additions Work Magic In A Bank On Yourself Plan

Free Multimillion-dollar Life Insurance Has Some Insurers Running For The Exits Forbes Advisor

![]()

What Does A Million Dollar Life Insurance Policy Cost In 2020

2021 Final Expense Life Insurance Guide Costs For Seniors

Dividend Paying Whole Life Insurance - The Alternative Fixed Income Vehicle Part 3 Seeking Alpha

How Much Does Million Dollar Life Insurance Cost Who Needs It

Comments

Post a Comment