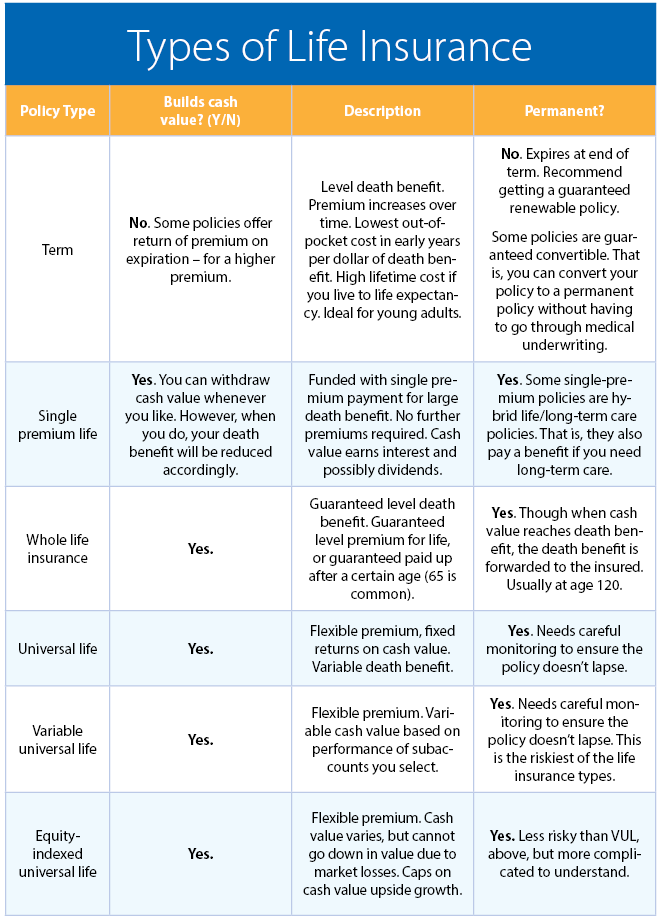

In the same example, if mary has life insurance that pays $100,000 to peter upon her death, then the face amount is $100,000. Key factors to consider when making changes with life insurance.

Term Life Vs Universal Life Insurance

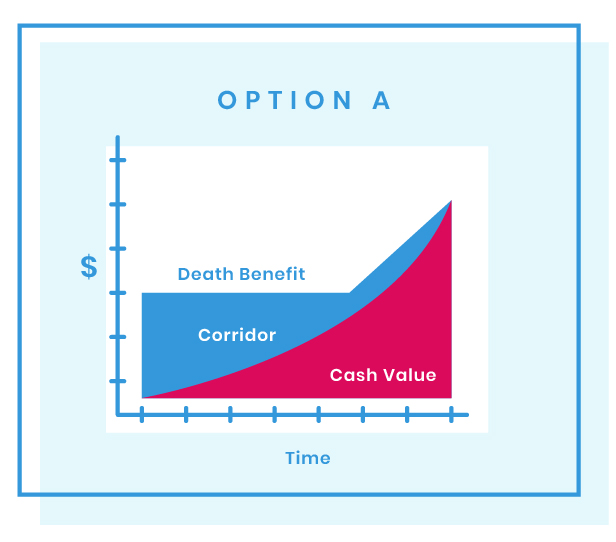

Option a is a level death benefit, called the specified or face amount.

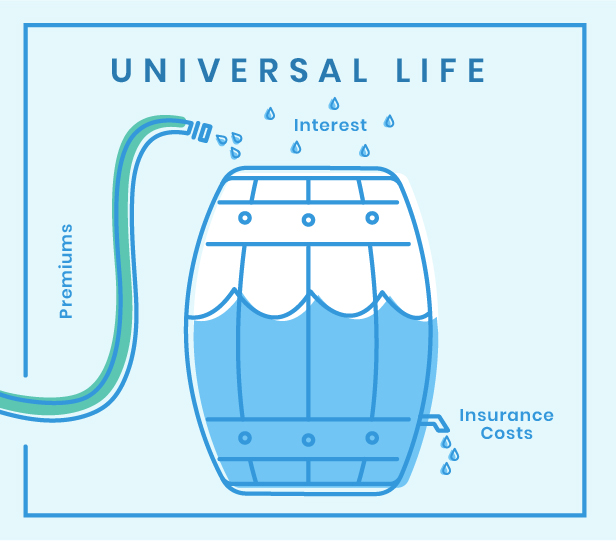

Universal life insurance face amount. The option to adjust your premium payment is. You can always choose to quit and walk away with what you have—your cash value (subtract any surrender charges). Universal life insurance is often sold using projections showing the amounts.

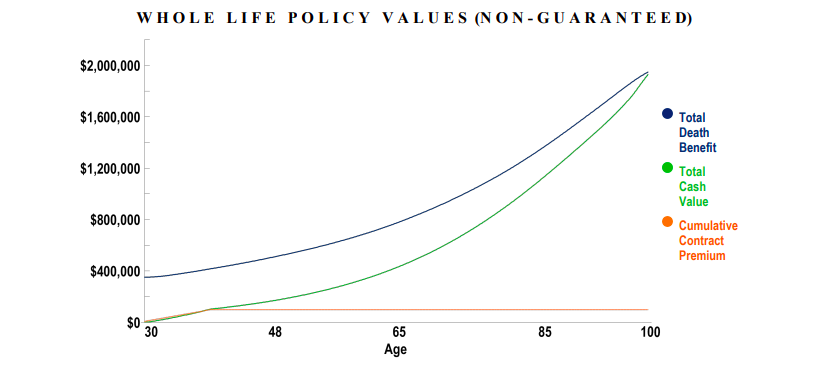

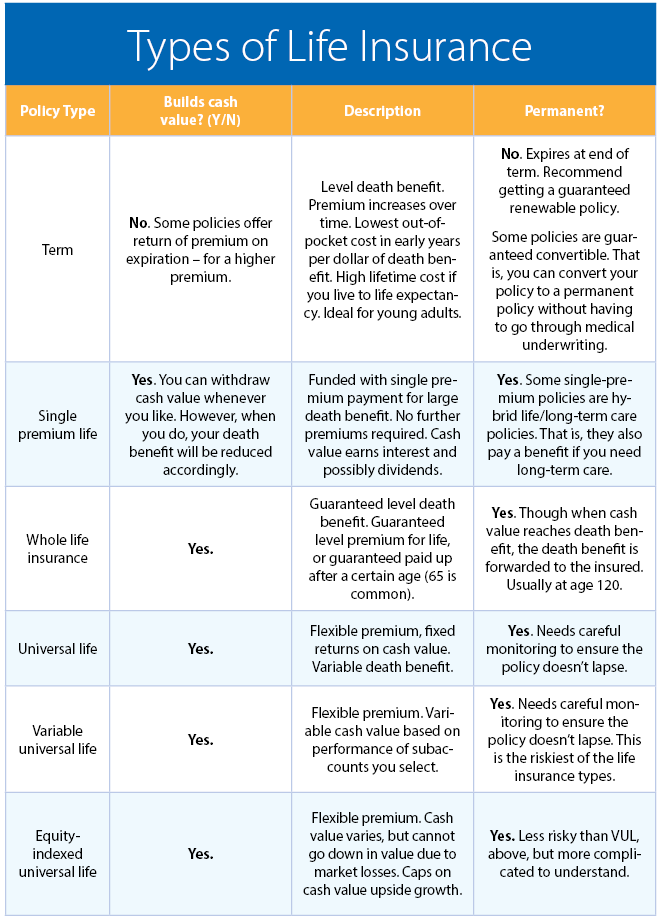

If you have (for example) cash value of $50k, a death benefit of $100k, and you are nearing that crossover point, you have to estimate the odds of the policy staying in force to pay a death benefit. When you buy a permanent life insurance policy such as a whole, universal, or variable life policy, you may discover that the policy has two vales, the face value and the cash value. It allows for a greater degree of flexibility and often lower cost than whole life insurance, another popular type of permanent insurance.

An example to help illustrate just how this happens: Changing the death benefit amount on a policy involves an irrevocable change in the outstanding amount of death benefit on a universal life insurance policy. The current status of the health of an individual is a key factor.

If the cash value on a policy is $10,000 and you die, the insurance company pays $50,000, but the insurance company keeps the $10,000 cash value. Universal life insurance (often shortened to ul) is a type of cash value life insurance, sold primarily in the united states. On you under employee insurance you may enroll for a face amount of insurance equal to one of the options below.

Insurance and annuities universal life insurance changing from option b to option a has no such requirement because, like conventional permanent insurance, the pure insurance amount decreases as the cash value increases, combining to equal the. A face amount change differs considerably from a death benefit option change. When a life insurance policy is identified by a dollar amount, this amount is the face value.

It’s called universal because it’s meant to be a product for. If the current person is uninsurable, it would be foolish to drop any life insurance. This is often far more easily accomplished with universal life insurance than with whole life insurance.

Universal life insurance is a type of permanent life insurance. Benefit classes face amount of insurance all employees option 1 100% of your annual earnings*. Option b is the face amount plus the cash value.

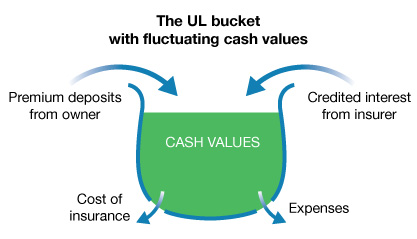

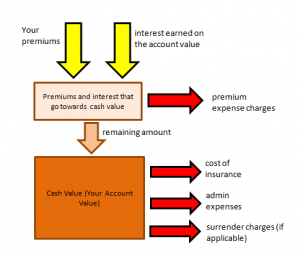

The policyholder’s flexibility extends to the amount of the monthly premiums paid, as well as their frequency. Amount for each benefit class: The premium should not be confused with the face amount, or insured amount, which is the amount that the insurance company has to pay out.

If you have a universal life policy and it has a cash surrender value then you are only insured for the difference between the cash value and the $50,000 face amount. Universal life insurance typically guarantees a rate up to a certain age, such as 100 or 105. Universal life has two basic death benefit options.

The face amount is still $250,000, but the contract has wording that describes how much the beneficiaries are paid. If you purchase universal life insurance at a younger age, your premiums will be cheaper. Universal life insurance is a type of permanent life insurance, which covers you until death, just like a whole life policy.

In option a, more of your payment goes toward building the cash value; Average universal life insurance quotes the cost of universal life insurance for a $500,000 policy can range widely from around $1,683 to $10,315, depending on your age when you buy the insurance. The policy is debited each month by a cost of insurance (coi) charge.

The $20,000 that remains will be collected by the insurance company. The price tag on universal life (ul) insurance is the minimum amount of a premium payment required to keep the policy. The option for which you enroll will be recorded by the included employer and reported to prudential.

Under the terms of the policy, the excess of premium payments above the current cost of insurance is credited to the cash value of the policy, which is credited each month with interest. For instance, if the face value of your whole life policy is $200,000 and the cash value that has accumulated is valued at $20,000 when you pass away, the beneficiaries of your policy will receive the $200,000 face value of your policy; The face value, or face amount, of a life insurance policy is established when the policy is issued.

In option b, more goes toward raising the death benefit through investing. It’s the amount of death benefit purchased, which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies. These are not variations of the same value, but are actually two different accounts associated with the policy.

(in some cases it can be more than the face amount based on gains in the contract and/or dividends.) Likewise, people ask, what is the purpose of establishing the. One of the most attractive features of universal life insurance is the ability to choose when and how much premium you pay, as long as payments meet the minimum amount required to keep the policy active and the irs life insurance guidelines on the maximum amount of excess premium payments you can make.

Universal life insurance (ul) universal life insurance lets you make two choices which are as follows.

How Does Whole Life Insurance Work Costs Types Faqs

Limited Pay Whole Life Insurance What Is It See The Numbers

Mesothelioma Benign Or Malignant Mesothelioma Universal Life Insurance Life Insurance Policy Insurance

Life Insurance Loans A Risky Way To Bank On Yourself

Universal Life Insurance Pros And Cons Termlife2go

Cash Value And Cash Surrender Value Explained Life Insurance

Life Insurance For Children A Look At The 4 Best Policies

What Are Paid Up Additions Pua In Life Insurance

Life Insurance Policy Loans Tax Rules And Risks

Division Of Financial Regulation Universal Life Premium Life Insurance And Annuities State Of Oregon

What Are Paid Up Additions Pua In Life Insurance

Life Insurance Loans A Risky Way To Bank On Yourself

Universal Life Insurance Pros And Cons Termlife2go

Limited Pay Whole Life Insurance Best Policies With Sample Rates

Understanding Universal Life Insurance Moneygeek

5 Disadvantages Of Indexed Universal Life Insurance Know Your Options

Why Almost Every Life Insurance Policy With Cash Value Stinks

Life Insurance Policy Loans Tax Rules And Risks

Understanding Life Insurance What Policy Type Is Best For You

Comments

Post a Comment