At fi rst blush you might think the 12 months) amounts to an annual rate of 8% on $300,000 taking on signifi cant risk. Regardless of what your financial advisor or agent recommends.

Annuity Beneficiaries Inherited Annuities Death

It depends on what you need and what you are trying to achieve.

Single life annuity vs lump sum. A single life annuity is an annuity that provides an income as long as the annuitant is living. People trying to decide between a lump sum or an annuity often focus on whether they could earn more by investing the lump sum, russell says. Your “lump sum vs annuity” decision comes down to if you need a lifetime income stream or not.

This tool compares two payment options: Often referred to as a “lottery annuity,” the annuity option provides annual payments over time. Married retirees who select the joint and survivor option typically accept lower monthly

Or receive an annuity for a specific number of years and pay taxes each year. A lump sum involves receiving a large cash payout once you retire, while a life annuity allows you to receive regular payments for the remainder of your life. When the annuitant dies, the contract ceases unless it contains a guarantee period.

Unless the annuity payment contains a cola provision, that monthly payment will eventually lose ground to inflation. The main benefit of this is that the monthly payments will be a bit more. Lump sum means the total sum (fee) which will have become payable to the consultant by the principal upon completion of the services.

These time periods could be weekly, monthly or annually. Powerball and mega millions offer winners a single lump sum or 30 annuity payments over 29 years. Let's look at how these two compare several factors.

For a given pension, a single life annuity generates higher monthly payments than a joint and survivor annuity, because it generally provides payments for a shorter period of time. An annuity allows you to regularly collect part of your money over a prespecified time frame. As far as claiming the benefits upon maturity of the plan is concerned, that is where the option of choosing a lump sum payout or monthly pension payouts comes into play.

Receiving a lump sum today, invest it yourself, and live off the proceeds after paying income taxes; The one thing that the lump sum offers that the annuity doesn’t is optionality. In other words, it’s your money.

If you do need a lifetime income, then that monthly pension amount hitting your bank account can combine with your social security payments to create your guaranteed income floor. A lump sum allows you to collect all of your money at one time. And these payments can qualify for the pension income tax credit.

Lotteries are often paid as annuities. But at retirement, people should switch from the. This flexibility would allow our client to spend more in the early years of their retirement when they are in better health than they will be in later years.

If the pension starts at 65, it has to pay at least $1,634/month. He'd like to know which option will serve him best f. Single life annuity means an annuity payable for the life of a participant.

On the other hand, an annuity is a series of steady payments that are made at equal intervals over time. With the lump sum, our client would have a choice in how to invest, spend, and bequest their money. Individuals who already have sufficient income sources—through social security, other pension benefits, or a large portfolio— might find an annuity less attractive than a lump sum.

Depending on the age and sex of the participant, the interest rate environment at the time of payout, and other factors, the cost of an annuity for a participant can be between 10 percent and 30 percent higher than the lump sum payout.

Explore Accounting Through Mind Mapping Mind Map Simple Mind Map Mind Map Design

Does An Annuity Plan Work For You - Businesstoday

Were Starting 2014 With The Mantra Inspirational Words Inspirational Quotes Quotes To Live By

How Do Structured Settlement Annuities Work Lifehealthpro Annuity Infographic Retirement Planning

Pin On Awesome And Informative Infographics

What You Need To Know About A Lump Sum Life Insurance Payout Sproutt

Lump Sum Png Images Pngwing

Lump Sum Or Annuity Distributions What You Need To Know - Rodgers Associates

Difference Between Annuity And Lump Sum Payment Infographics

Lump Sum Or Annuity How To Make The Right Pension Choice For You The Motley Fool Pensions Pension Fund Annuity

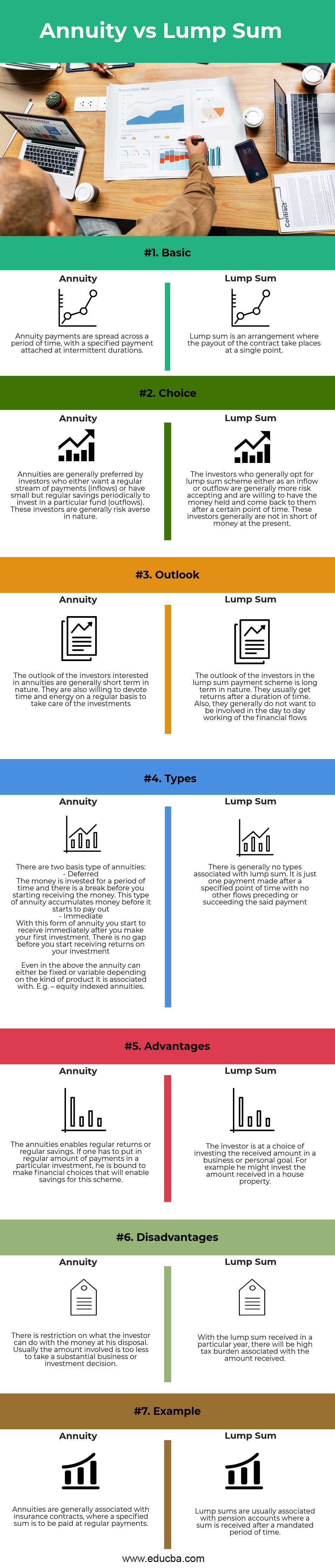

Annuity Vs Lump Sum Top 7 Useful Differences To Know

Should I Take A Lump Sum Or Annuity From My Pension Or Retirement Package

Difference Between Annuity And Lump Sum Payment Infographics

So You Won The Lottery - Is The Lump Sum Payment Best Lottery Winning The Lottery Sum

Pin By Terry Quinn On Life Insurance Contracting Company Annuity Life

At What Age Should I Buy An Annuity Our Deer Annuity Tax Refund Life Insurance Marketing Ideas

Annuity Vs Lump Sum Top 7 Useful Differences To Know

Annuity Meaning And Definition - What Is Annuity Icici Prulife

Lic Insurance Hyderabad 9912359818 Life Insurance Agent Annuity Single Premium

Comments

Post a Comment