In life insurance, a contract clause which provides that for certain reasons, such as misstatements on the application, the company may not contest payment of benefits (assuming premiums have been paid) and the policy has been in force during the lifetime of the insured for a certain period, usually two years after issue. You can also set up.

Is A Paid-up Life Insurance Policy Paid Off Trusted Choice

P is looking to purchase a life insurance policy that will pay a stated monthly income to his beneficiaries for 20 years after he dies and a lump sum of $20,000 at the end of that 20 year period.

How long does coverage normally remain on a limited-pay life policy. K buys a policy where the premium stays fixed for the first 5 years. Whole life insurance has both a face value and a cash value. Modified premium life insurance policies allow you to pay lower premiums for the first 5 to 10 years.

The cash value of vul is invested into separate assets of your choosing,. You could lose health coverage on your last day. Incremental limited pay life insurance policies between 10 and 30 years can be customized depending on when you want to stop paying into your policy.

Policy periods are also important in determining your payment due date. A whole life policy funded by one upfront. This period can be of any duration.

Paid policy benefits may be used for any purpose. Whole life insurance builds cash value. Choosing your life insurance term length.

The policy's face value is what your beneficiaries receive when you die. An insurance policy period is the time frame during which an insurance policy is effective. Employers decide how long you get to keep your group health plan after you leave your job.

Beginning october 1, 1997, a life insurance policy covering a person 64 years old or older, which has been in force for at least 1 year, may not be lapsed for nonpayment of premium, unless, after expiration of the grace period, and at least 21 days before the effective date of lapse, the insurer has mailed a notification of the impending lapse in coverage to the. Limited pay whole life¶ limited pay whole life policies have level premiums that are limited to a specified number of years. This type of policy is ideal for someone who wants to buy a policy with a high death benefit and knows they will be in a better position to pay higher premiums in the future.

The premium then increases in year 6 and stays level thereafter, all the while the death. What requires an agent to have proper finra securities registration in order to sell them, except for: The short answer to how long does the coverage normally remain on a limited pay life policy is usually until age 100 or until death.

For instance, if you buy a term plan with a coverage term of 25 years and premium payment term of 10 years, you would have to pay premiums only for 10 years while the coverage would continue. Limited premium payment plans are term life insurance plans which allow you to pay premiums for a limited tenure while your coverage continues for a longer period. Insurers have steadily been extending out the maximum age.

The shorter the pay period,. Term life insurance policies work by paying a benefit to beneficiaries if the insured person dies during the policy term. However there is a more nuanced version of this.

So if you have a $500,000 policy, they'll receive $500,000 at your death. After that, the premiums will rise. Term life insurance is inexpensive, as low as $11 per month for a $100,000 benefit.

K buys a policy where the premium stays fixed for the first 5 years. The employer may let a covered employee keep it through the weekend, the rest of the month or even longer — regardless of whether you get laid off or quit. Premium payments limited to a specified number of years.

Typically your beneficiaries will receive a life insurance payout anywhere from 30 to 60 days after the claim was submitted. Variable universal life insurance (vul) is a type of permanent life insurance policy, meaning that as long as you keep paying your premiums, your beneficiaries will receive a death benefit when you die. Charges a lower premium for initial savings, then raises rates significantly after two to three years.

The premium then increases in year 6 and stays level thereafter, all the. Does a a modified endowment contract (mec) exceed or fall below the maximum amount of premium that can be paid into a policy and still have it recognized as a life insurance contract. The premium then increases in year 6 and stays level thereafter, all the while death benefit remains the same.

The investment gains from a universal life policy usually go toward. A life insurance policy’s “term length” is the policy’s duration, or how long it will last until expiring. K buys a policy where the premium stays fixed for the first 5 years.

Therefore, a “period certain” guarantees that payments are made for at least a certain period of time, such as for 20 years after the death of the insured. It also has a cash value component that grows with each premium payment and gains interest.

2021 Guide To Burial Funeral Insurance Senior Plans Cost

What Are Paid Up Additions Pua In Life Insurance

What Are Paid Up Additions Pua In Life Insurance

Germany Commonwealth Fund

Is A Paid-up Life Insurance Policy Paid Off Trusted Choice

Health Insurance Costs Understand What You Might Pay If You Have A Health Insurance Plan With Deducti Health Insurance Plans Work Health Healthcare Management

All You Need To Know About Whole Life Insurance Forbes Advisor India

Pin On Ms

Universal Health Coverage In Indonesia Concept Progress And Challenges - The Lancet

Tuip4-alor_cmm

Universal Health Coverage In Indonesia Concept Progress And Challenges - The Lancet

Universal Health Coverage In Indonesia Concept Progress And Challenges - The Lancet

What Are Paid Up Additions Pua In Life Insurance

What Are Paid Up Additions Pua In Life Insurance

Pin On Masks

All You Need To Know About Whole Life Insurance Forbes Advisor India

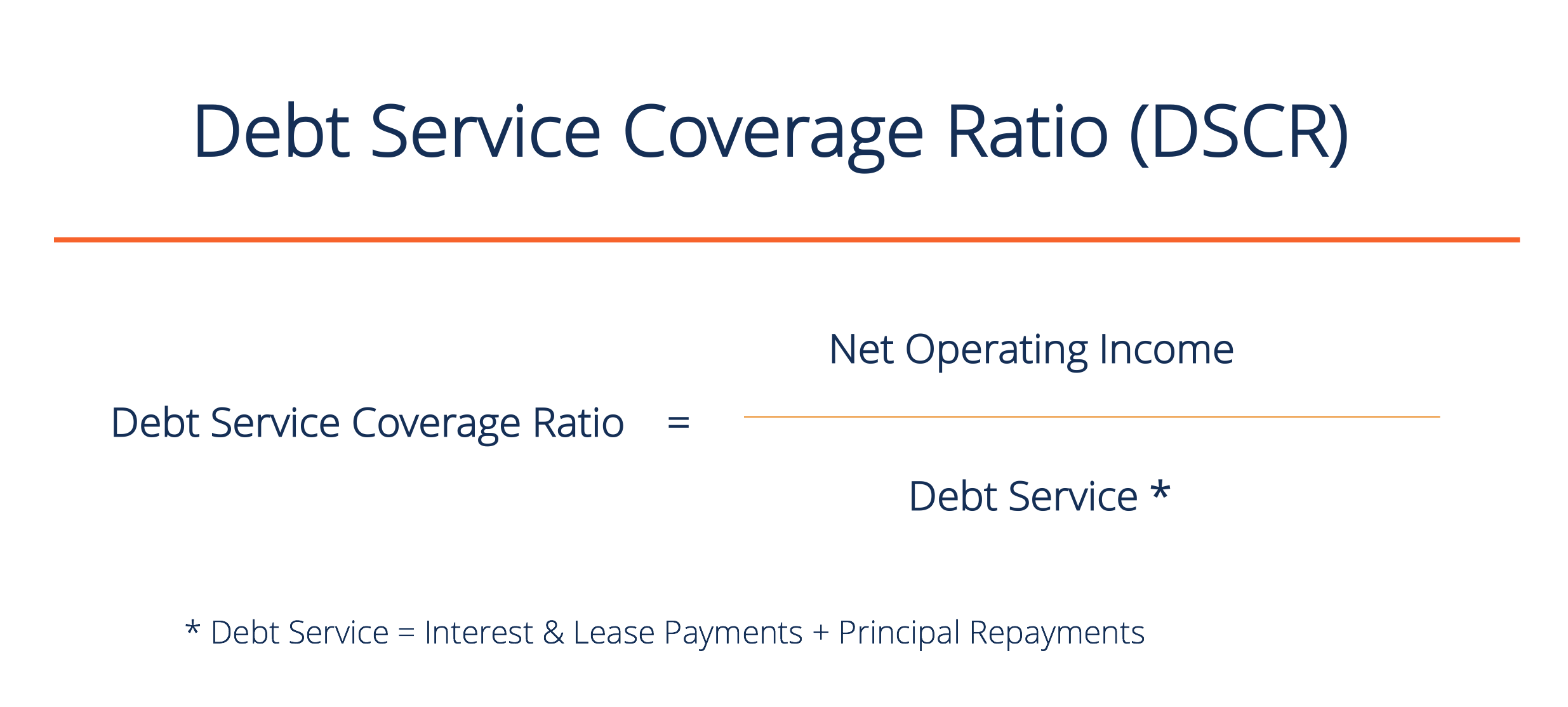

Calculate The Debt Service Coverage Ratio - Examples With Solutions

How Does Whole Life Insurance Work Costs Types Faqs

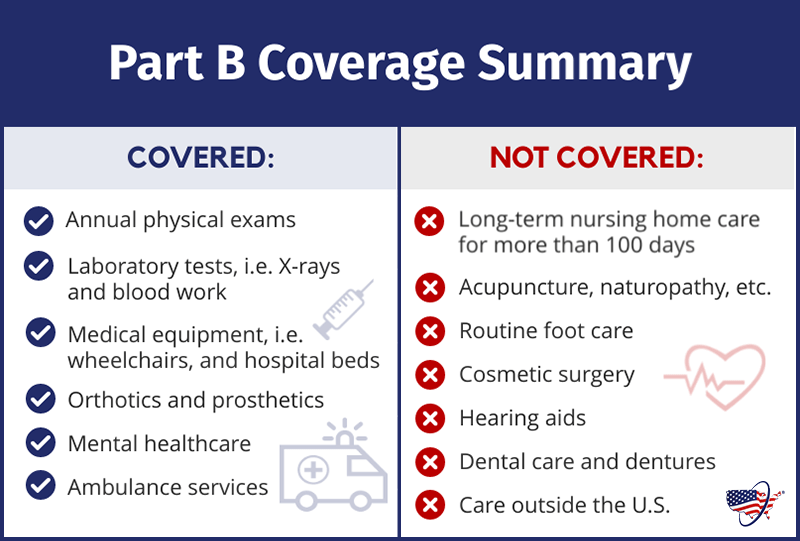

Medicare Part B - Everything You Need To Know In 2022 - Medicarefaq

Comments

Post a Comment