If you outlive the number of years paid into your annuity, it continues to pay out — guaranteed — for life. Straight life annuities do not include a death benefit, so payments can’t be made to a beneficiary.

Is A Straight Life Policy Right For Me - Paradigmlifenet Blog

Straight life annuity forgoes this added benefit in favor of higher guaranteed payments while the annuitant is alive.

Straight life annuity payout. Because the payouts will be shorter in duration, they offer the highest periodic payments. Straight life fixed index annuity. A straight life retirement annuity means that the retiree will receive a monthly annuity payment for as long as she lives, and then the payments stop.

Therefore, a “period certain” guarantees that payments are made for at least a certain period of time, such as for 20 years after the death of the insured. Additional payments aren’t made to a beneficiary. Funds in the annuity continue to earn this rate of return, minus payouts, over the lifetime of the annuity.

It’s guaranteed to earn a fixed rate of return. Unlike some other options that allow for beneficiaries or spouses, this annuity is limited to the lifetime of the annuitant with no survivor benefit. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder.

This protection is increasingly relevant as a growing number of americans report inadequate retirement savings. A straight life annuity is often used to provide an income stream in retirement. A fixed or variable annuity that pays a certain monthly or (rarely) annual sum for life of the annuitant and carries no death benefit.

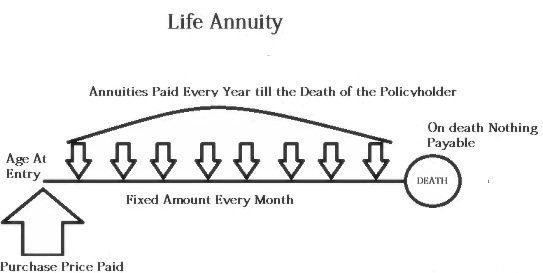

A straight life fixed index annuity is a deferred fixed index annuity that is annuitized on a straight life payout in the future. Under a straight life annuity contract, the annuity makes payouts on a regular basis for the remainder of the annuitant’s life, no matter how long the annuitant lives. With a straight life annuity, you pay a certain amount of money and then receive regular payments until you die.

With no payouts after the owner's death, this means that heirs, beneficiaries, and spouses receive nothing. A lifetime annuity guarantees payment of a predetermined amount for the rest of your life. When it's finally time to retire, the investment will start paying out and keep paying out.

In return, you will receive income for the rest of your life. If the formula provides $30 per month for each year of service, the single employee with 40 years of service would receive $1,200 per month ($30 x 40 years). In other words, when you die, the payments stop—even if you die shortly after you retire.

This option helps protect against longevity risk, or the threat of outliving your money in retirement. $0.00 10 years certain and life annuity: That's way some people invest in a straight life annuity.

This annuity can be stipulated to pay out for the annuitant's lifetime or for a certain number of years. This option is akin to the installment refund option except that it contains two timeframes for payout, not just at death. Generally speaking, an annuitant buys a straight life annuity and makes installment payments for it throughout his/her working life.

Other forms of annuity pay you only for a certain amount time. A straight life annuity is a type of fixed annuity. The amount of the payments is determined by the amount of the purchase payment and the annuitant’s age at the time the payments begin.

Say the annuity provides income for life or ten years, then whichever comes first is the. You can start a straight life annuity at. This is different from a term annuity which only pays you for a fixed amount of time.

The monthly payment is calculated on the life of the annuitant. A straight life annuity is an insurance contract that pays out a series of fixed payments over the life of the owner, or annuitant. Once the annuitant dies, all payments stop and the policy terminates.

A straight life policy, which is sometimes referred to as a straight life annuity, is a type of plan that’s designed to provide a regular income to the annuitant as long as they live. That means you’ll receive an income stream for life. The payments end when the annuitant passes away.

Life annuities, as the name implies, pay out for the rest of your life. They may also be called single life, life only or straight life. It will give you an income as long as you live.

A lifetime annuity is a financial product you can buy with a lump sum of money. A straight life annuity provides a guaranteed income stream until the death of the annuity owner. A straight life annuity, sometimes called a straight life policy, is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a.

Annuities And Individual Retirement Accounts - Ppt Video Online Download

Life Annuity

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

Page Title

Straight Life Annuity 2021 The Annuity Expert

The Pros And Cons Of Joint Life Annuities Trusted Choice

Straight Life Annuity Discover How It Works What You Need To Know - Wealth Nation

When Can You Cash Out An Annuity Getting Money From An Annuity

Joint And Survivor Annuity The Benefits And Disadvantages

/stacks-of-coins--a-compass-and-documents-signaling-finances-184104157-eea22b5b70b744318f04c2b6f54a5ef4.jpg)

Straight Life Annuity Definition

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

Page Title

What Is A Straight Life Annuity Retirement Watch

Annuity Payout Options Immediate Vs Deferred Annuities

Straight Life Annuity Definition

Straight Life Annuity Discover How It Works What You Need To Know - Wealth Nation

Page Title

Period Certain Annuity What It Is Benefits And Drawbacks

What Are Your Annuity Payout Options - Due

Comments

Post a Comment